9h14 ▪ 6 min read ▪ by

May 2025 did not disappoint. While some feared a new relapse, the numbers tell a completely different story. A breeze of hope is blowing through the crypto industry, driven by the in-depth analysis from Binance Research. The latest monthly report paints a picture where institutional inflows, the recovery of Ethereum, and the boom of tokenized assets converge. A crucial month, to be decoded straightforwardly.

In Brief

- The crypto market jumped 10.3% in May, extending the bullish momentum from April, announces Binance Research

- Bitcoin ETFs attracted $5.2 billion, IBIT leads, GBTC declines, signaling consolidation.

- Ethereum surged 43.9%, driven by Pectra and a massive investment from Sharplink.

- The RWA market climbed 260%, with private credit and public debt dominating inflows.

A Strong May for Crypto Markets

According to Binance Research, author of a recent study on Asian investors, the crypto market grew by 10.3% in May, extending the upward momentum initiated in April. This rebound was not without turmoil: persistent volatility, fueled by geopolitical uncertainties, led to the liquidation of nearly $1 billion in short positions on bitcoin and ether.

Despite this, the overall trend remains decidedly positive. This is evidenced by net inflows into US spot Bitcoin ETFs, which reached $5.2 billion, their highest level since November 2024. The flagship IBIT product from BlackRock dominated the inflows. Conversely, GBTC recorded $320 million in outflows, indicating a market consolidation in ETFs.

Publicly traded companies are not left behind. They now hold 809,100 bitcoins, spread across 116 companies. This massive adoption is the result of clearer regulations and the emergence of new accounting standards. Some, such as Sharplink, are even starting to diversify their treasuries into ETH, SOL, or XRP.

In this context, the “Pectra” update of Ethereum was seen as a catalyst: +43.9% for ether in May. According to Binance Research, this technical advancement significantly improves network scalability and strengthens transaction security. Sharplink, once again, made a mark with an allocation of $425 million in ETH, thus cementing its recognition as a bona fide reserve asset.

DeFi and Tokenized Real Assets: The New Drivers

The Binance Research analysis also highlights a spectacular surge in the DeFi and RWA sectors. In May, decentralized finance grew by 19%, driven by product innovation and an increase in total value locked (TVL).

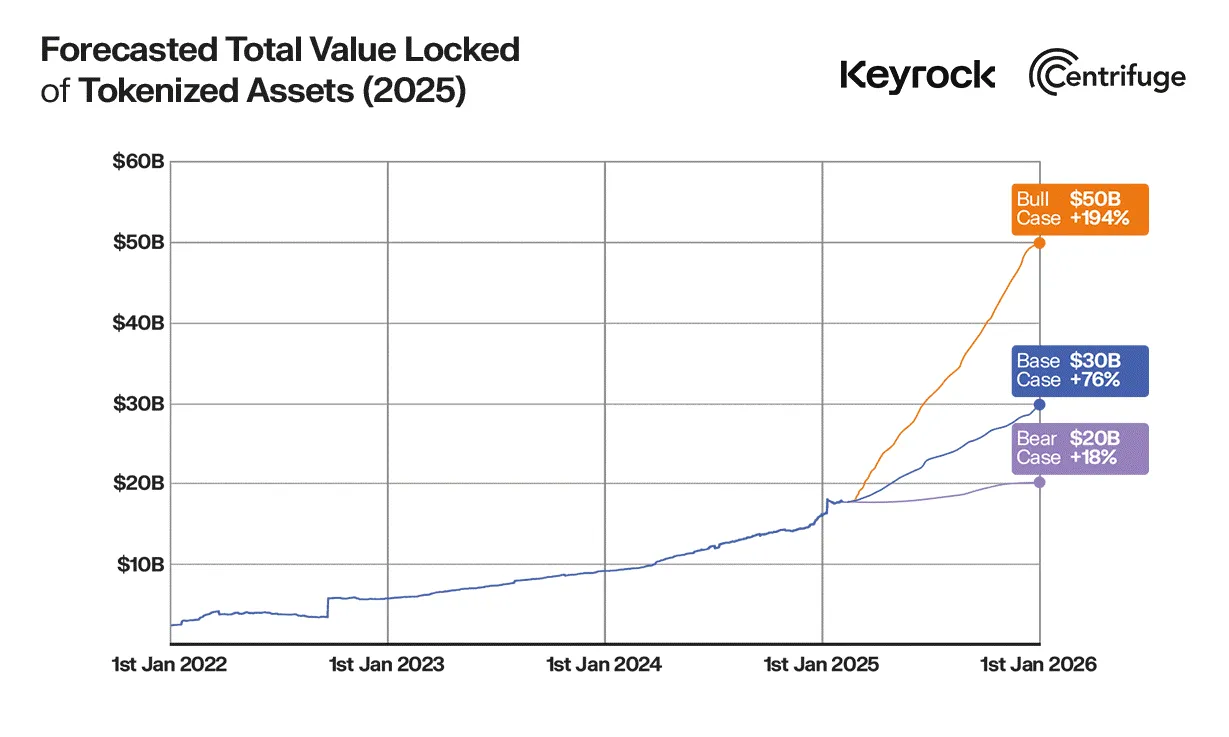

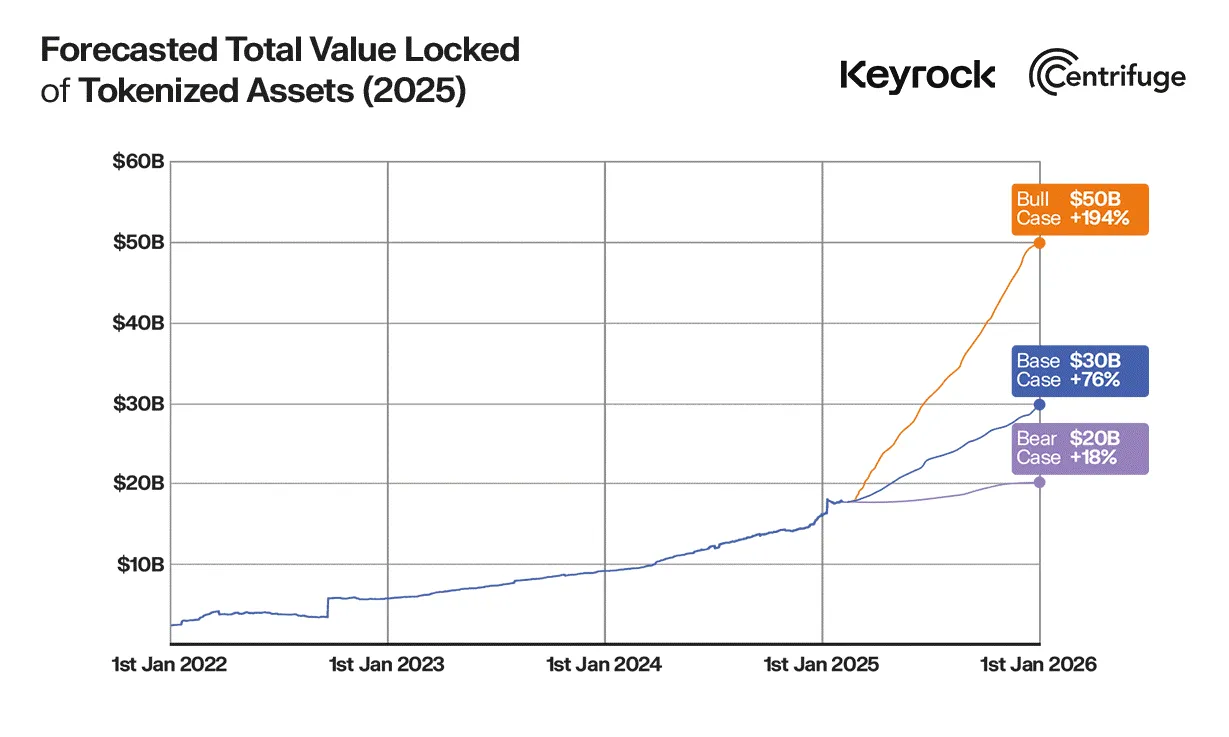

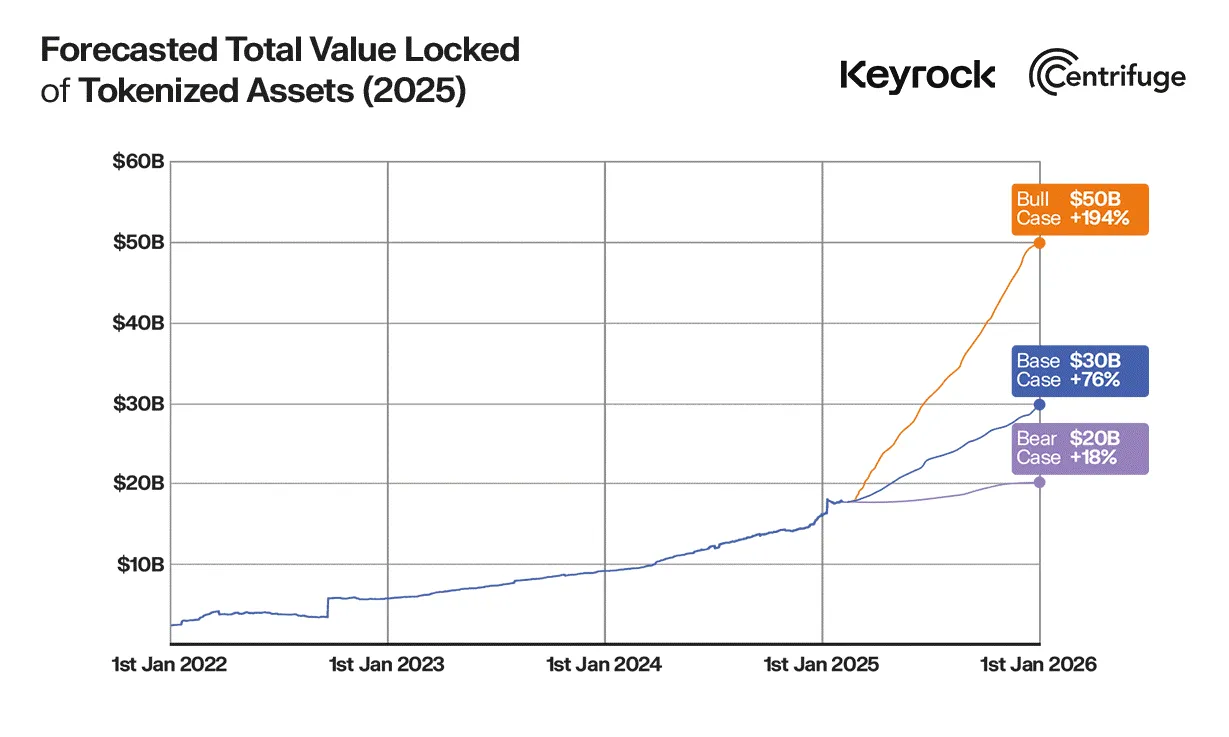

The most striking surprise, however, is on the side of tokenized real assets. The RWA market soared 260% in the first half of 2025, reaching a valuation of $23 billion. This sector is now mainly supported by private credit (58%) and US public debt (34%).

This structural movement, also documented by Keyrock, reflects an infrastructure-driven will: to create a bridge between traditional finance and the crypto universe. By integrating bonds and traditional financial products into the blockchain ecosystem, institutions find a new reliable and regulated entry point.

What stands out here is the growing appetite for instruments considered stable, now accessible in digital and fractionalized form. Tokenization transforms illiquid assets into easily tradable, traceable, and potentially inclusive opportunities.

With the emergence of new accounting standards, DeFi and RWAs are shaping up as drivers of the next cycle. Binance Research emphasizes that these transformations could attract an even larger institutional inflow in the months to come. For the crypto community, this changes everything: from the individual investor to large corporations, new portfolio management logics are emerging.

RWAs: Toward an Accelerated Democratization of the Crypto World?

RWAs, or Real-World Assets, represent a new gateway to the crypto universe. The tokenization potential transforms what was once reserved for private markets into assets accessible to all. Thanks to blockchain, securities such as bonds or real estate become fractionalizable, traceable, and tradable in real time.

The Binance Research report shows that the majority of flows to RWAs concern already structured markets: private credit, treasury bills. This demonstrates the search for stability. But the real lever lies elsewhere: the capacity of RWAs to ease mass adoption. In the long term, this dynamic could reshape the entire global financial infrastructure.

Ease of issuance, transparency, and efficiency of digital transfers make them an ideal entry channel for both novice investors and seasoned institutions. By simplifying access to usually complex products, RWAs offer unprecedented appeal.

Here’s what the numbers tell us:

- 260% growth for RWAs in the first half of 2025;

- $23 billion in valuation reached;

- 58% of flows come from private credit, versus 34% from US public debt;

- $425 million in ETH allocated by a publicly traded company;

- 19% growth in the DeFi sector in May alone.

Within this logic, RWAs are no longer just a trend. They outline a possible architecture for future finance. A finance where crypto infrastructure becomes the foundation of the real economy.

Some crypto companies are not wasting time. Real, for example, claims to want to unlock real-world assets (RWA) for everyone. This concrete strategy reflects a paradigm shift. The future of decentralized finance is already being built on these foundations.

Maximize your Cointribune experience with our “Read to Earn” program! For every article you read, earn points and access exclusive rewards. Sign up now and start earning benefits.

La révolution blockchain et crypto est en marche ! Et le jour où les impacts se feront ressentir sur l’économie la plus vulnérable de ce Monde, contre toute espérance, je dirai que j’y étais pour quelque chose

DISCLAIMER

The views, thoughts, and opinions expressed in this article belong solely to the author, and should not be taken as investment advice. Do your own research before taking any investment decisions.

You can contact us for more informations or ads here [email protected]