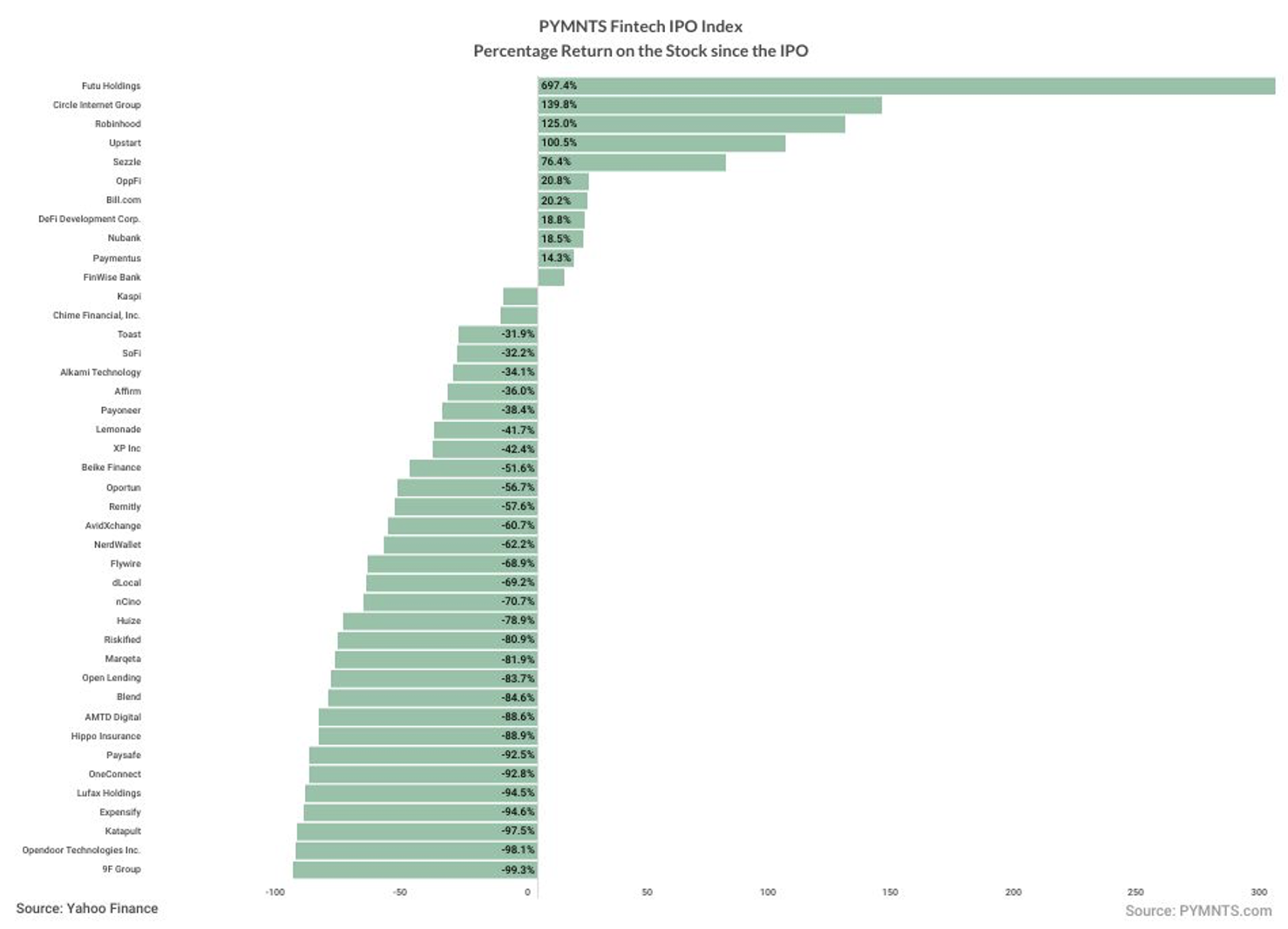

Headed into the Juneteenth holiday, and nearing the end of a shortened trading week, the FinTech IPO Index slipped 1.3%.

There are some notable gains, and some excitement around stablecoins, as the GENIUS bill passed the Senate and now moves to the House for consideration in that legislative chamber.

Circle Soars and DeFi Development Jumps

Circle shares soared 70%, as OpenPayd and Circle partnered to offer global businesses a unified fiat and stablecoin infrastructure layer. The efforts will bring OpenPayd’s financial infrastructure and Circle Wallets’ stablecoin infrastructure to enable OpenPayd’s enterprise clients to use both traditional banking rails and blockchain-based networks to move and manage money globally.

The joint efforts streamline conversion between fiat currencies and Circle’s regulated stablecoin, USDC, this solution will provide OpenPayd’s clients with faster access to liquidity, lower settlement costs, and the ability to develop new use cases across payments, treasury and digital asset services, the firms said. Circle shares roared ahead by 70%.

As reported by PYMNTS, DeFi Development Corp. announced that it obtained a $5 billion equity line of credit. The company, which was formerly known as Janover and says it is the first U.S. public company with a treasury strategy built to accumulate and compound Solana (SOL) digital assets, entered into a share purchase agreement (ELOC) with RK Capital Management.

Under the terms of the agreement, DeFi Development will have the right, but not an obligation, to issue and sell as much as $5 billion in shares of its common stock to RK Capital, DeFi Development said. The ELOC enables DeFi Development to raise capital gradually; the firm said it will use the proceeds from the ELOC to continue accumulating SOL and accelerating growth in its SOL per share. DeFi Development shares gathered 19%.

Platforms Offset the Gains

But the FinTech platforms offset those notable gains.

Blend shares sank more than 10%. In an announcement, PHH Mortgage, a mortgage servicer based in the U.S. and operating as a subsidiary of Onity Group Inc., is expanding its partnership with Blend focused on refinancing and home equity processes. PHH Mortgage has expanded its use of Blend’s technology platform, already powering its mortgage lending operations, to now include Rapid Refi and Rapid Home Equity.

The deal increases automation and operational efficiency across loan applications through pre-qualified offers at the start of the journey and a reduction in manual steps tied to those applications.

OppFi shares slipped 9.5%. Expensify’s stock lost 9.5%.

In other platform-related news, Robinhood said Tuesday (June 17) that it has begun rolling out two tools as part of its effort to become the top destination for active traders. The new tools include charting capabilities on mobile and options simulated returns pre-trade, the trading platform said.

Legend charts, which are one of the tools most often used by Robinhood’s active traders, were previously available only on desktop. On mobile, they enable traders to zoom in and out and scroll back and forth quickly and easily, and place an order with a few taps, according to the company’s announcement. Robinhood shares rose 4.5% through the past five trading sessions.

You can contact us for more informations or ads here [email protected]