- Solana (SOL) is trading at $145.16, down 0.70%, with weekly losses of nearly 8%.

- A bullish falling wedge chart pattern suggests a possible rebound if key resistance is breached.

- VanEck’s proposed spot Solana ETF (VSOL) being listed on DTCC signals an imminent launch.

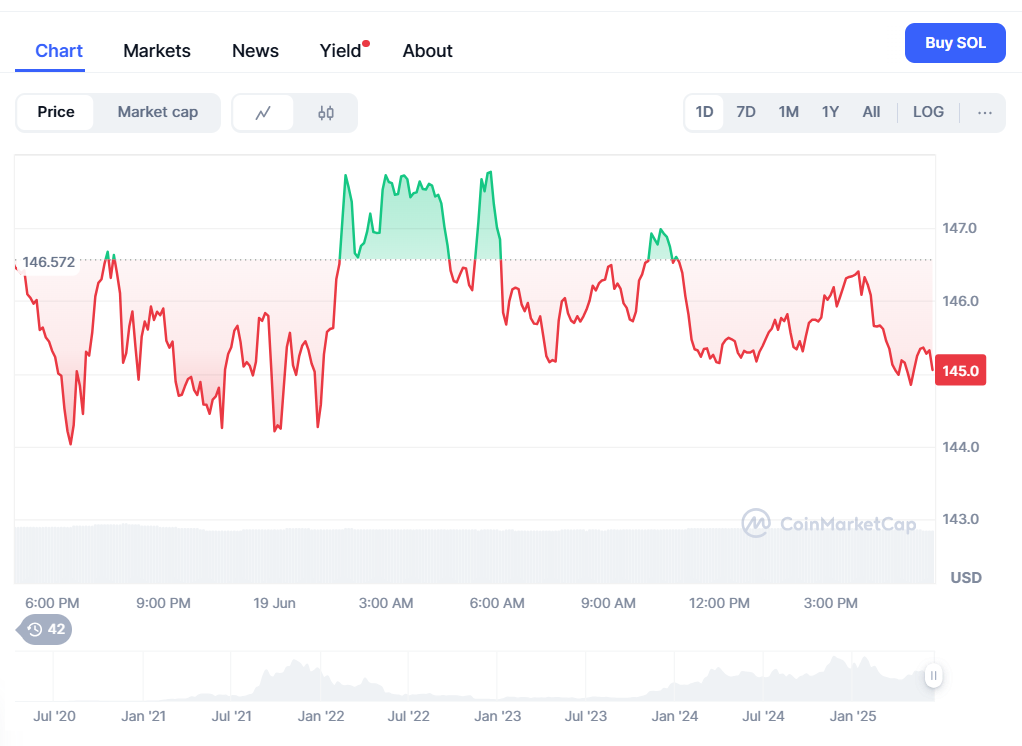

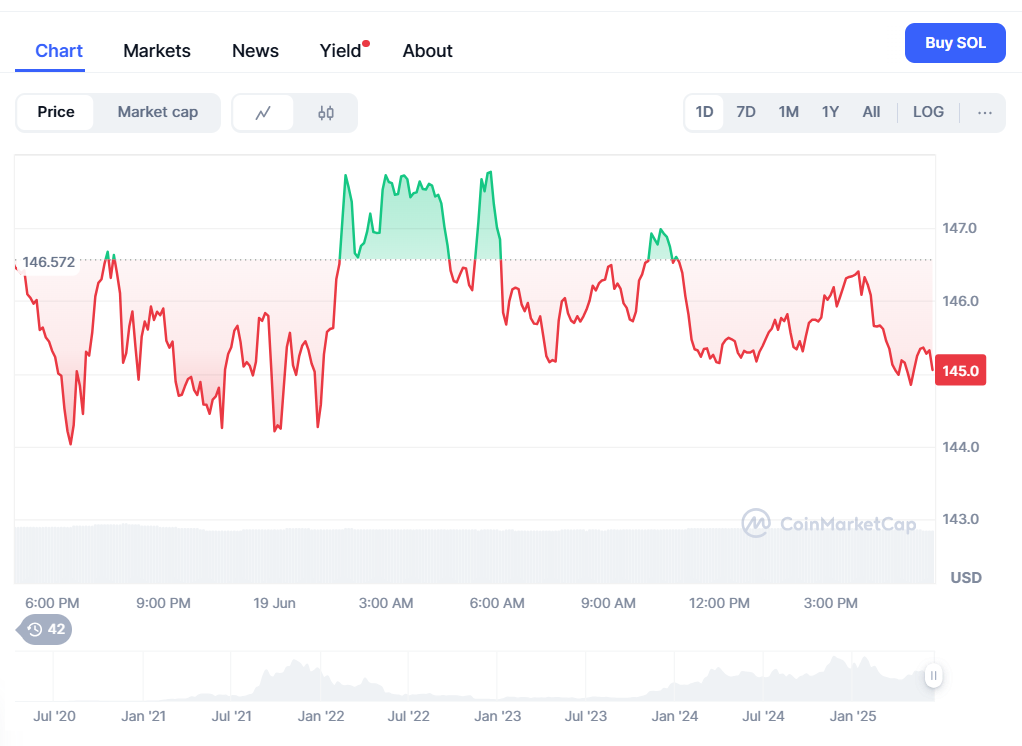

Solana (SOL), is currently trading at $145.16, almost having a 0.70% decrease in the past 24 hours period. The trading volumes also dropped by around 4.07%, with a total overburden of $3.51 billion within the last twenty-four hours period. Over the Session brought on gained about eight per cent thus highlighting short-term bearish sentiment on SOL system

Some experts see a “falling wedge” pattern on Solana’s 3-day chart, which often signals a possible price increase. Right now, the price is still below a key resistance level at $157 and also under the 50-day Simple Moving Average (SMA).

If buyers can push the price above these levels, SOL could rise toward $180 or even $200. But there’s also risk, if the price falls below the 200-day SMA, it could drop further, with strong support expected between $125 and $130.

SOL price prediction for 2025

Predictions for Solana’s future price differ a lot depending on the source. DigitalCoinPrice is optimistic, expecting Solana to rise above its previous high of $294.33 and possibly reach around $320.26 by the end of 2025. This positive outlook is based on strong investor confidence and a hopeful market mood.

On the contrary, Changelly presents a less aggressive look at it. According to their analysis, SOL should not go beyond $154.86 in 2025 and its average price would be approximately $155.32 per token.

For June 2025 alone, the latest prediction gives SOL a ceiling of $147.75 which is near current levels only Their projected ROI stands at 2.1%, implying an underperformance in the short run unless there are significant shifts of momentum towards the coin.

VanEck spot Solana ETF appears on DTCC list

One of the most promising signs for Solana comes from the world of traditional finance. Investment firm VanEck has proposed a spot Solana ETF (Exchange-Traded Fund) with the ticker symbol VSOL. This ETF has now appeared on the DTCC’s “active and pre-launch” list, which is a key step toward launching.

While this doesn’t mean it’s ready to trade just yet, it shows that important parts like trade processing and asset storage are already set up. VanEck’s Ethereum ETF followed a similar path before it went live. Being listed on the DTCC list shows that big financial institutions are starting to take SOL seriously.

If the ETF gets approved, it would be the first spot Solana ETF in the U.S. Experts believe this could bring in a lot of investor money and encourage other firms to create similar Solana-based products. It also suggests that regulators may be becoming more open to ETFs based on cryptocurrencies beyond just Bitcoin and Ethereum.

Related Reading | Solana SOL’s Balancing Act: Support Check At $59

You can contact us for more informations or ads here [email protected]